Gold is a popular investment in Pakistan, with many individuals and businesses buying and selling gold as a way to diversify their portfolios and protect their wealth. However, investors also have to keep an eye on various factors while investing in the gold market. There are number of elements that affect the 1 tola gold price in Pakistan. Therefore,it’s quite essential to do your homework and understand the market conditions before making any investment decisions. Therefore, let’s analyze the current market and factors affecting it this week.

Gold Market Performance last week

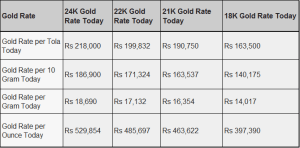

The 1 tola gold price in Pakistan (24K) started the week at Rs 215900 and ended the week at Rs 218000.

Global demand and supply

The gold prices showed a considerable decline after recovery in the US dollar index U.S and treasury yields as it is a known fact that its prices are inversely proportional to dollar value. The international gold prices started the week at $1994 per ounce and ended the week at $1970.5. In addition to that, higher dollar value negatively affects the commodity demand. Finally, it also increases the appeal of risk-heavy assets, while also limiting flows of foreign capital into the United States. Resultantly, these things will also affect 1 tola gold price in Pakistan as.

Moreover, experts at reliable websites such as Trading Economics’ experts expect per ounce gold price to hover around $ 1900 mark till March 2024.

Local Pakistani experts believe that weak international economic prospects will push bullion prices high and it would also affect the 1 tola gold price in Pakistan.

USD to PKR exchange rate

Pakistani rupee is showing some kind of stability due to the optimism surrounding the revival of the IMF loan package. The PKR started the week at Rs 284.50 and ended the week at Rs 283.50.

However, experts are not much hopeful about the future of Pakistani economy and Pakistani rupee. They believe that the dollar’s value would increase due to bad economic management of PML-N led government. But, it is encouraging news for bullion investors as 1 tola gold price in Pakistan would rise with the falling rupee value.

Inflation

The situation for common Pakistani citizens has gone from bad to worse in last one year as SPI inflation rate has reached 47.23% at April 19, 2023. It has made extremely tough for people to buy even basic household items thus marring Eid celebrations.

The Pakistan Bureau of Statistics data revealed that the wheat flour prices rose by 144% along with tea by 104%, potatoes by 99, and high-speed diesel by 103% and gas by 108%.

In this environment, gold is often seen as a hedge against inflation because its value tends to hold up well in times of inflation. This is because gold is a tangible asset that is not tied to any particular currency, so its value is not eroded by inflation in the same way that paper currencies can be.

As a result, when inflation occurs, Pakistani investors often turn to gold as a store of value and a way to protect their wealth. This increased demand for gold would surely drive up the 1 tola gold price in Pakistan as more people would be buying it..

Political and economic Uncertainty

The quarterly economic report by Policy Research Institute of Market Economy highlights that the government’s restrictions on imports has succeeded in decreasing the deficit from $12 billion to $3.8 billion in July-Feb 2023 from previous year. However, it also has negatively affected the manufacturing sector performance as its output reduced by 5.56 % in last 8 months compared to last year. This slowdown has badly affected the inflation and macroeconomic prospects of the country.

The slowdown in production sector also caused by decline in the private burrowing by Rs219 billion in first two months of 3rd quarter of FY 2023 as total borrowing stands at Rs7.4 trillion. State of bank of Pakistan has recently raised its benchmark interest rates by 21 % that is the highest level in Asia. Moreover, the declining forex reserves have started causing serious scarcities of imported drugs and medical apparatus.

On the other hand, political uncertainty is at its height after PML-N led government has refused to accept the Supreme Court decision to hold elections on 14th may 2023. It is terrible as this can create divide between two pillars of the state and might push the country towards anarchy.

PML-N led government has also approved a legislation to limit the power of chief justice but that is against the will of the constitution. Experts believe that present political and economic uncertainty will positively affect the 1 tola gold price in Pakistan.

What to do?

While gold is believed to be a safe haven asset, but its 1 tola gold price in Pakistan can be volatile and subject to market fluctuations. Therefore, it is quite essential to consult with a financial advisor or investment professional before jumping into the gold market.

Ammad Hafeez Qureshi, a MBA finance with over 10 years of content writing experience, has worked with various firms.

Ammad Qureshi is a passionate writer who uses Youth Table Talk to support the next generation’s success in personal and professional lives, addressing common financial and Mental Health issues.

Do you want solutions for your social and psychological problems?

Then Subscribe to our newsletter